When considering digital vs. paper invoices, can switching to a digital option from traditional paper methods significantly benefit your business, or does it come with a number of drawbacks?

Simply put, switching to digital invoices offers many benefits such as cost savings, more efficient time management and better financial tracking. However, it is important to plan this transition carefully to address cybersecurity issues and ensure compliance with data protection laws.

Financial Management Efficiency: Digital vs. Paper Invoices

In the debate of digital vs. paper invoices, the contrast in efficiency and cost-effectiveness becomes apparent. Digital solutions eliminate the tangible costs associated with their paper counterparts—no more expenditures on paper, printing, and postal services. Even more compelling is the seamless connection to accounting software, effectively reducing the manual labor of data entry. This integration not only slashes administrative overhead but also minimizes human error, optimizing for both time and accuracy. With each transaction recorded instantaneously, business owners gain a penetrating view of their financial health, allowing for swift and strategic fiscal decisions.

Tip: Regularly reviewing financial reports generated by digital systems can identify trends and inform future business strategies.

The impact of digital invoicing on payment turnover is also notable. Features facilitating immediate actions, such as 'click-to-pay', substantially curtail delays in revenue collection, thus reinforcing the business's cash flow—a critical component of economic stability and growth. Moreover, as the enterprise scales, digital systems adapt more efficiently, handling increased invoice traffic without a proportional rise in workload or cost. Lastly, the meticulous tracking and documentation intrinsic to digital platforms can fortify tax compliance, potentially uncovering deductible expenses once easily overlooked.

Time Management and Productivity: A Digital vs. Paper Invoices Comparison

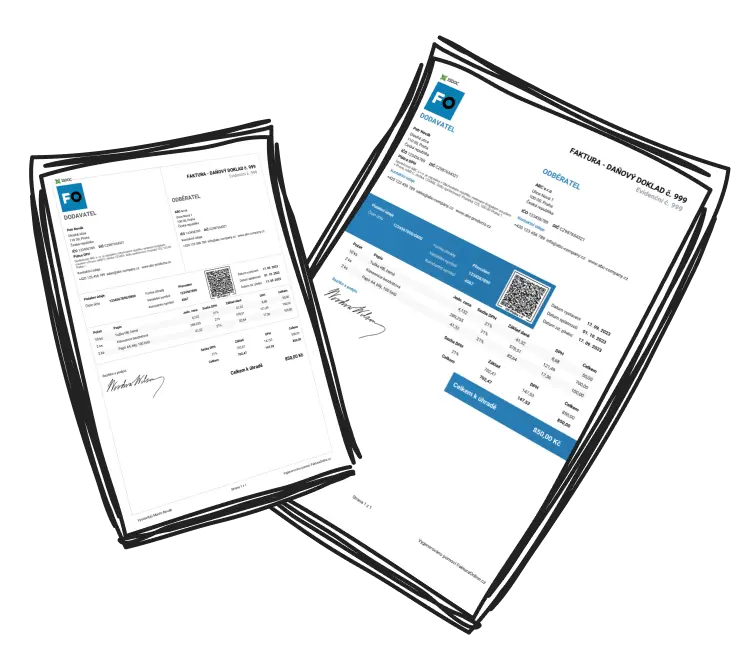

Transitioning to digital invoicing from paper introduces a game-changer in time management—the power of automation. For swift invoice creation without complications, explore InvoiceOnline, designed for effortless handling right in your browser.

An automated system can send follow-up reminders to clients about outstanding payments, reducing the time spent on accounts receivable.

Centralization is another pillar—having all invoice-related documents in a single, digital repository. The efficiency of this organization aligns with David Allen's philosophy, where knowing the current status of all projects is crucial to peace of mind and productivity. With digital systems, accessibility of information is instantaneous, eliminating the physically taxing search through filing cabinets. This streamlining extends into interoperability, enabling different software solutions to communicate and exchange data smoothly, diminishing the redundancy characteristic of paper systems.

Indeed, the most remarkable advantage of digital invoicing may be its adaptability. Whether in the office or on the move, invoices can be created, sent, and managed remotely, epitomizing flexibility and ensuring that the invoicing process harmonizes with the business owner's hectic schedule.

Security Considerations in the Digital vs. Paper Invoices Debate

While the transition to digital invoicing inherently mitigates risks like physical loss or damage, it introduces potential cybersecurity threats. The response to these threats lies in vigilant security measures. Enforcing robust encryption protocols for data in transit and stringent authentication processes guards sensitive financial information against unauthorized access. In terms of resilience, digital invoicing systems offer an unequivocal edge with comprehensive backup and recovery strategies, ensuring business continuity even when faced with technical failures.

Conformity with data protection policies is integral to maintaining not only the security but also the credibility of a business. These standards bear the dual responsibility of safeguarding client data and reinforcing the trust that clients place in the business.

Tip: Regular security audits and staff training programs on best practices in cybersecurity can significantly reduce the risk of data breaches.