InvoiceOnline.com allows you to issue several types of invoices, including the Invoice with reverse charge.

Reverse charge invoice

This type of invoice is issued when the tax is not recognised and paid by the supplier of the service or goods, but by the customer. The VAT is therefore not paid by the customer to the supplier, but paid directly to the State.

The reverse charge option is not applicable to all services and goods and is a system between VAT payers only. The reverse charge is not applicable to end-users.

Reverse charge - the details of the invoice:

Basic data for invoicing (ID number, date of taxable transaction, ...)

VAT values paid by the customer of the service or goods

It must be stated in the note that VAT is paid by the customer

❗️ InvoiceOnline.com fills in the note automatically when you select the invoice type - Reverse charge invoice. It is not necessary to enter anything else in the note when issuing the invoice.

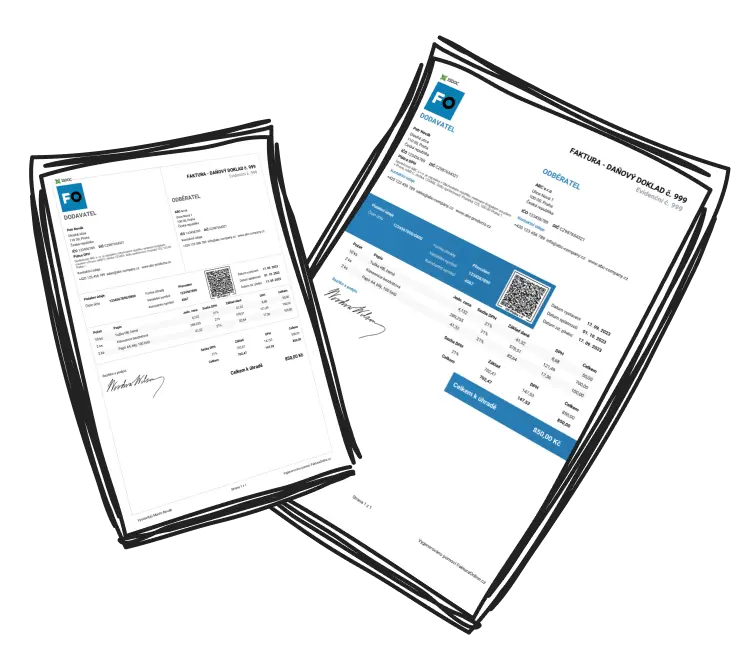

Reverse charge invoice template