The end of the year is an ideal time to take care of key tasks that ensure a smooth transition into the new year and provide entrepreneurs with advantages in financial planning, taxes, and organization. We’ve prepared a list of essential steps that should be considered.

- 1. Closing Accounting and Preparing for an Audit

- 2. Tax Optimization and Overview of Deductions

- 3. Review Contracts and Business Terms

- 4. Purchasing and Financing Equipment

- 5. Preparing for New Tax Laws and Regulations

- 6. Securing Sufficient Financial Reserves

- 7. Preparing Marketing Plans for the New Year

1. Closing Accounting and Preparing for an Audit

The most important step at the end of every year is closing your accounting. Check all invoices, expenses, and income to ensure the accuracy of the year-end settlement. This not only helps avoid future issues but is also crucial for the correct preparation of your tax return.

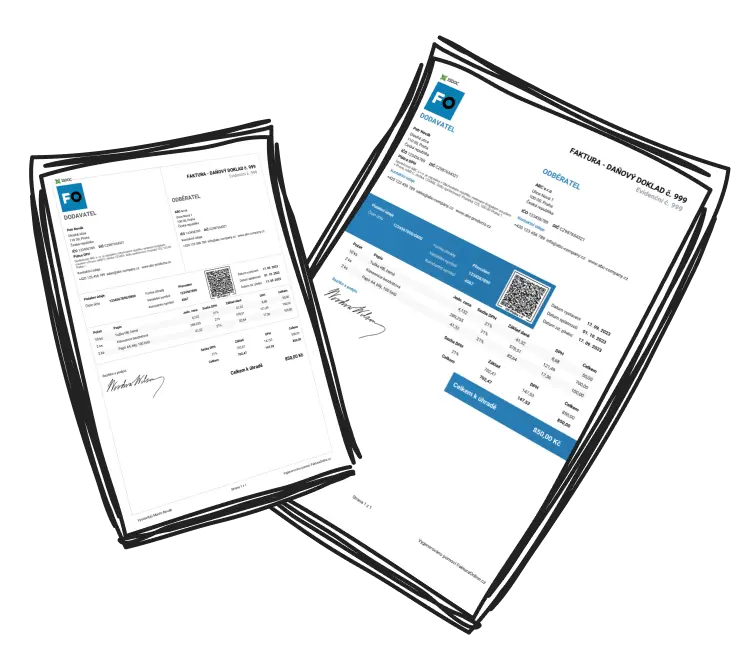

If you use invoicing tools, make sure all your invoices for the year are properly accounted for. Tools like InvoiceOnline can help with this.

Key steps:

Check all invoiced and paid amounts.

Verify the accuracy of your year-end closing and expenses.

Don’t forget to review all tax liabilities and obligations.

2. Tax Optimization and Overview of Deductions

It’s important to make sure you’re eligible for all possible deductions and credits, such as contributions to retirement plans or educational expenses. This will help you avoid high tax liabilities. In some cases, it’s beneficial to make certain investments or expenses within the current year to reduce your tax base.

Pay attention to all available credits and deductions that can lower your tax liability. Make sure none are missed during the year.

3. Review Contracts and Business Terms

It’s a good practice to regularly review important contracts and business terms. This includes contracts with employees, suppliers, clients, and leasing companies. Update conditions that may have changed due to new laws, or optimize terms for better collaboration in the upcoming period.

Key steps:

Review all contracts that have expiration dates or automatic renewals.

Make sure business terms comply with new legal requirements.

Consider renegotiating contracts that no longer meet current conditions.

4. Purchasing and Financing Equipment

If you’re planning investments in new equipment or technology, don’t forget about potential tax advantages like depreciation deductions and other benefits that may apply in the next year. If you’re planning to purchase new equipment, such as computers, office technology, or vehicles, it could be beneficial to make the purchases within the current year.

Purchase equipment by year-end – this way, you can apply tax deductions and secure better conditions for depreciation.

What to purchase:

Office technology (computers, printers, software).

Vehicles and other business equipment.

Investments in technological innovations that will support your productivity.

5. Preparing for New Tax Laws and Regulations

Get familiar with new tax laws that might impact your business in the coming year. It’s the ideal time to prepare and adjust your accounting, processes, and contracts to align with these changes. Avoid unexpected financial issues that could arise in the coming months.

Some changes in the tax system in 2025 may affect your costs. Ensure you’re informed about all the changes.

What to prepare for:

Changes in sales tax (Sales Tax), income tax, and other taxes.

New business regulations related to data protection (such as GDPR).

Environmental tax regulations.

6. Securing Sufficient Financial Reserves

If you tend to leave financing until the last minute, consider creating financial reserves for the upcoming period. This can help you avoid cash flow problems at the beginning of the new year, especially after holiday periods when business activity can sometimes be slower.

Don’t forget to ensure sufficient financial reserves for the start of the year. Have cash ready to cover necessary expenses in the first few months of the year.

7. Preparing Marketing Plans for the New Year

Reviewing and preparing marketing strategies for the next period is crucial for a successful start. Evaluate which marketing campaigns worked well in the past year and what you’ll focus on in the future. Preparing new offers, campaigns, or targeting new markets can significantly contribute to your business growth.

Focus on key tasks that will ensure your business is well-prepared for the new year without unnecessary complications. Optimize your finances, review contracts, and make necessary investments. This way, you’ll not only simplify administration but also avoid potential issues and take full advantage of tax benefits.