Issuing an invoice may seem routine, but small mistakes or missing details are among the most common reasons clients delay payments — or why you might run into trouble with the IRS.

What Is an Invoice and Why It Matters

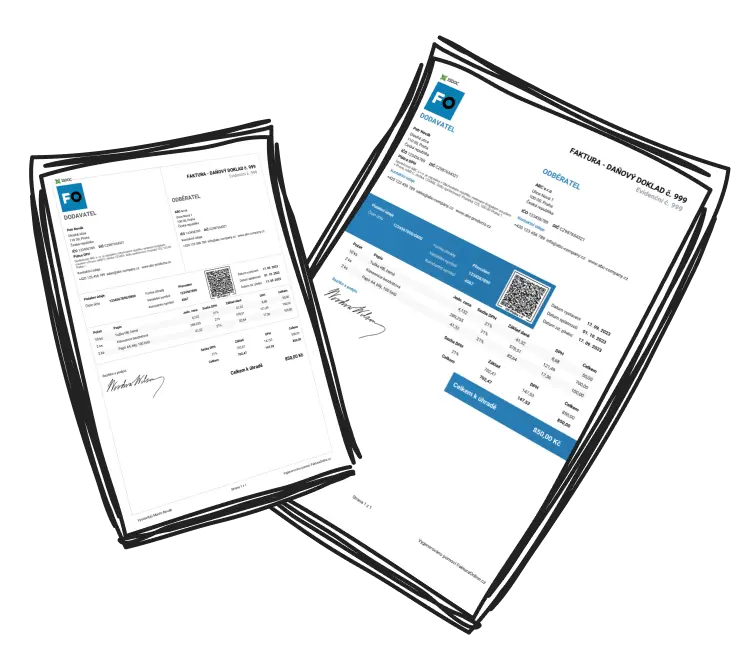

An invoice is a financial document confirming that you’ve provided a service or sold goods. It also serves as proof of your income and expenses, forming the foundation of your business finances.

Many people confuse an invoice with a tax document, but they’re not identical.

Tax invoices are issued by businesses that charge sales tax.

Standard invoices are used by freelancers or businesses not registered for sales tax.

The difference lies in whether the document includes tax details.

What a Tax Invoice Must Include

If your business collects sales tax, you’re required to issue a tax invoice for each taxable transaction. A well-structured invoice saves you time, reduces stress, and helps you avoid penalties during audits.

Include multiple payment options. Add online payment links or QR codes so clients can pay directly from the invoice — no delays, no excuses.

A tax invoice should include:

Your business and client details (name, company name)

Business address

Employer Identification Number (EIN) or Tax ID

Business registration or license information (if applicable)

Description and quantity of goods or services

Invoice date, due date, and date of supply

Payment method and account number

Subtotal, tax rate, and total amount due (including sales tax)

Your invoices must be numbered sequentially and traceable.

Missing or duplicate invoice numbers can raise red flags during a tax audit. Keep all your documents organized and stored safely.

What a Standard (Non-Tax) Invoice Must Include

Self-employed professionals and small businesses that are not required to collect sales tax issue standard invoices.

These are simpler but must still include all key details — and be properly labeled as “Not registered for sales tax.”

A standard invoice should include:

Business and client details

Business address

EIN or business ID (if available)

Business registration (if applicable)

Description of goods or services, quantity, and price

Invoice date, due date, and completion date

Payment method and account number

If you maintain formal bookkeeping, the same rules apply — you’ll just have additional record-keeping requirements.

Why Proper Invoicing Builds Trust

A correctly issued invoice isn’t just an obligation — it’s part of your business identity. When your invoices are complete and professional, clients pay faster, trust grows, and your brand looks credible.

With InvoiceOnline.com, you can create compliant, polished invoices in seconds — from the header to the final total — without worrying about missing details.

You might also be interested in our article on The Importance of Trademarks: Protecting and Registering Your Brand in Business.