Invoicing and taxes go hand in hand. Learn how proper invoicing impacts your tax returns, why it pays to keep your records organized, and how modern tools can help you avoid errors and penalties.

The Importance of Correct Invoicing for Taxes

Invoicing and tax obligations are closely related. Every invoice issued represents a record of income or expense that must be included in your tax filing.

Errors, late invoices, or missing information can lead to:

Penalties from the IRS

Inaccurate financial records

Issues during an audit

InvoiceOnline.com can help you avoid these issues by ensuring your invoices are always accurate and on time.

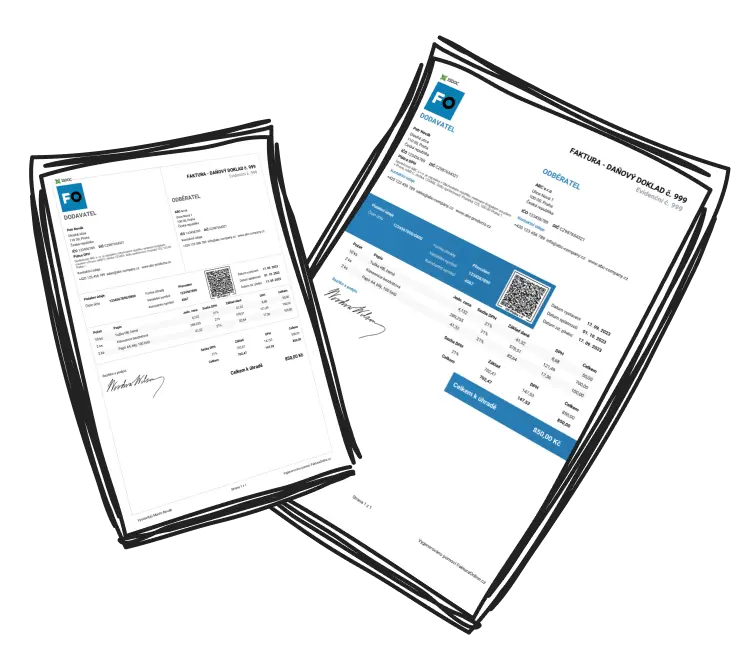

The Invoice as a Tax Document

An invoice is not just a payment request. It’s a legal document that confirms the completion of a taxable transaction.

Invoices must include certain legally required information, such as:

Identification of the seller and the buyer

Issue date and transaction date

Description of the goods or services

Price before tax, the applicable tax rate, and the total tax amount (if you are a registered taxpayer)

The absence or incorrect details on an invoice can violate tax obligations and lead to penalties.

Types of Invoices and Their Tax Implications

Different types of invoices have varying impacts on your accounting and taxes:

Standard Invoice – Confirms the provided service or delivered goods.

Advance Invoice – Not subject to tax reporting immediately, but once payment is received, a tax document must be issued for the amount received.

Proforma Invoice – Serves an informational purpose only, without affecting accounting or taxes.

If you are a taxpayer and issue an advance invoice for $20,000, you will report tax only after receiving the payment and issuing the corresponding tax document for the payment received.

For example, if you issue an advance invoice, you will not report tax until you receive the payment and issue a tax document.

Invoices and Tax Deductions

Invoices are the basis for claiming deductible expenses.

To qualify as a deductible expense, the item must:

Be related to business operations

Be supported by a valid invoice

Be recorded in the correct accounting period

The IRS recommends keeping invoices for at least 7 years from the transaction date to provide proof during audits.

During an Audit: The Importance of Order

During a tax audit, invoices represent the most crucial evidence. A well-organized invoicing system allows you to:

Prove the legitimacy of income and expenses

Justify the amount of tax owed

Avoid penalties for not maintaining proper records

How Online Tools Can Help

An online tool like InvoiceOnline.com helps you stay on top of all your documents—automatically tracking deadlines, ensuring the accuracy of your invoices, and giving you an overview of your payments. Save time and avoid unnecessary mistakes.

Summary

Invoicing is not just an administrative necessity—it is a fundamental tool for tax transparency and ensuring the security of your business.

Keep your records organized, stay updated on legal changes, and use automation to ensure timely compliance without stress.

For more details on what a correctly issued invoice must contain, check out our article on What Should an Invoice Include?