Creating a professional invoice is a key skill for freelancers to ensure timely payments, maintain professionalism, and manage financial records effectively. Follow these steps and insights to craft invoices that are clear, professional, and legally sound.

How to Write an Invoice as a Freelancer

Invoicing is a crucial skill that many freelancers find challenging. However, creating a proper invoice is straightforward and essential for timely payments and maintaining professionalism. Here's how to write an invoice as a freelancer with a step-by-step approach:

Create a Clear Header:

Begin with your name or business name, address, phone number, email, and logo (if applicable). Label the document clearly with the word "Invoice."Add Client Information:

Include your client’s full name, company name (if applicable), and address to avoid confusion.Assign an Invoice Number and Date:

Use a unique invoice number for tracking, and include the issue date to establish timelines.Describe Services Provided:

Write a detailed breakdown of the services or products you provided. Specify quantities, service dates, and rates to ensure clarity.Calculate Totals:

Add up subtotals, taxes (if applicable), and other fees to determine the total amount due.Specify Payment Terms and Instructions:

Include payment options (e.g., bank details or PayPal ID) and payment deadlines like "Net 15" or "Net 30."

Pro Tip

Always format your invoice number systematically, such as #001, #002, or include the date for better tracking (e.g., Invoice_20231101).

What Details Should Be Included in a Freelancer Invoice?

Missing details in your invoice might cause payment delays or disputes. Here's what you need to include when writing an invoice as a freelancer:

Your Business Contact Information: Full name, business name (if any), address, phone number, and email.

Client Information: Name, company name (if applicable), and address.

Invoice Number and Date: Essential for tracking purposes.

Payment Due Date: Clearly state when the payment is expected.

Itemized Services Provided: Use a table to specify the service description, quantity, rates, and subtotal.

Total Amount Due: Include taxes or fees and emphasize the grand total amount.

Payment Instructions: Include relevant payment details (bank account, PayPal ID, etc.) for the client.

Terms & Policies: Mention late payment penalties or refund conditions.

Important to Double-Check

1. Invoice number matches your records.

2. Payment due date is clearly marked to avoid confusion.

Why Is It Important for Freelancers to Write Proper Invoices?

Failing to write proper invoices can lead to unpaid work and tax issues. Learn why writing an accurate invoice as a freelancer is essential:

Proper invoices act as formal requests for payment and legal documentation of work completed. They minimize payment delays by ensuring all information—like services rendered, dates, amounts, and payment terms—is crystal clear to the client.

Invoices also build professionalism and strengthen trust. A polished invoice conveys credibility, encouraging clients to view you as a reliable partner. Additionally, invoices are vital for tax compliance, organized records, and settling disputes, serving as proof of income and services rendered.

Neglecting proper invoicing can result in frequent payment delays and potential legal issues during tax filing or billing disputes.

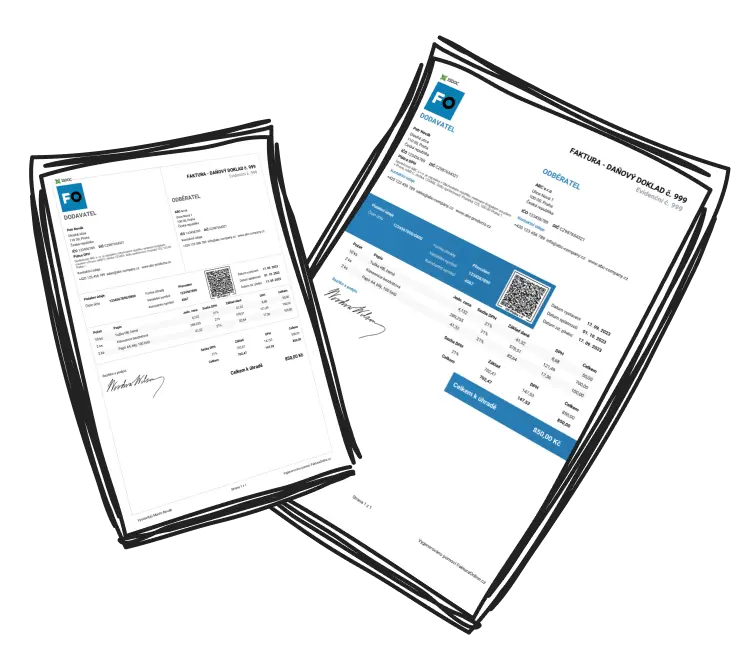

How Can a Freelancer Format Their Invoice for Clarity and Professionalism?

A poorly formatted invoice can confuse clients and delay payments. Ensure your invoice as a freelancer is clear and professional by following these steps:

Clean Fonts: Use readable fonts like Arial or Calibri in 11pt-12pt sizes. Avoid decorative fonts.

Simple Branding: Include a logo and subtle use of your personal or business color palette for professionalism.

Clear Layout: Align content into sections (e.g., Billing Info, Services Provided). Use a table format to keep details easy to read.

Highlight Key Info: Use bold text for critical information like the total amount due and payment deadline.

Tips for Formatting

1. Save invoices as PDFs to lock formatting and prevent edits.

2. Name files professionally, e.g., 'Invoice_#101_YourName.pdf.'

3. Organize your invoice as titled sections for quick navigation.

4. Emphasize urgency by making the due date stand out in bold text.

What Tools or Templates Can Freelancers Use to Write Invoices?

Save yourself hours by not designing invoices from scratch. Discover tools and templates that can help you write an invoice as a freelancer efficiently:

Wave Apps: A free tool for creating personalized invoices, including payment tracking.

FreshBooks: Offers automated invoicing and payment integration for professionals.

Canva: Ideal for beautifully designed, customizable invoice templates.

QuickBooks: Integrates invoicing with accounting for seamless management.

Invoice Ninja: Provides free simple templates and additional features via paid plans.

Microsoft Word/Excel Templates: Perfect for offline invoice drafting and customization.

Example Template

Create invoices with platforms like Canva for visually appealing designs that align perfectly with your branding.

By following the tips and tools shared in this guide, freelancers can ensure their invoices are clear, professional, and prompt for payments.