A poorly written invoice often leads to confusion and delayed payments—don’t let that happen to you! Writing an effective invoice is simple if you follow these clear steps:

Mark Your Document as an Invoice: Clearly label your financial document as "Invoice" to ensure its purpose is understood.

Include a Unique Invoice Number: Assign a unique number to each invoice for easy tracking and reference.

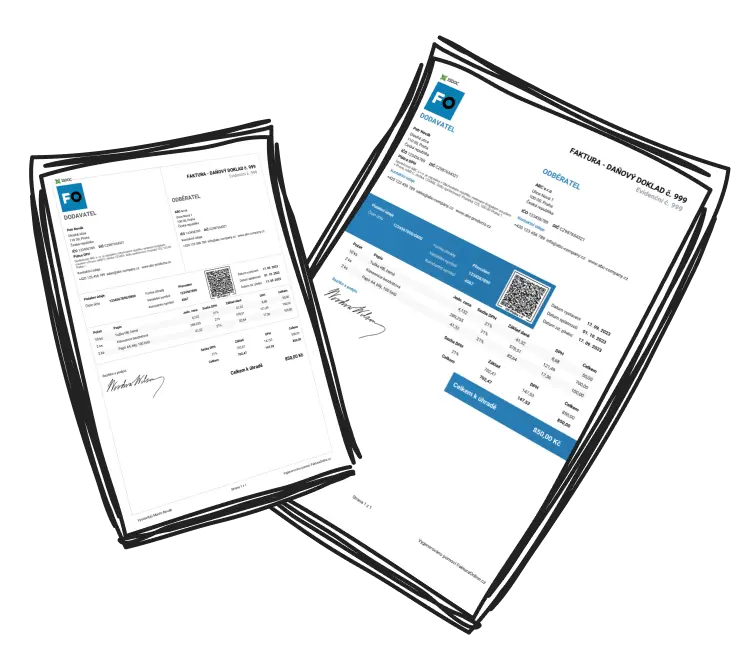

Add Contact Details for Both Parties: Clearly state your business name, logo, address, and contact information. Include the recipient’s name, address, and relevant details for a professional touch.

Provide an Itemized Breakdown: List goods or services provided, including descriptions, quantities, rates, and totals for each line item. This eliminates confusion and disputes.

State Payment Terms Clearly: Define payment due dates, methods (e.g., bank transfer, PayPal), and any terms, such as late fees.

Highlight the Total Amount Payable: Clearly show the total in both numerical and word format to prevent any misunderstanding.

Writing an invoice with these elements ensures professionalism and makes it easy for clients to process payments without delays.

What Are the Essential Components of an Invoice?

An invoice lacking essential details is as risky as sending a blank check. Always include crucial elements when writing an invoice:

Invoice Number: Assign a unique and traceable number.

Issuing and Receiving Parties: Add contact details for both seller and buyer, including business names, addresses, and tax IDs (if applicable).

Itemized List and Prices: Provide detailed descriptions, quantities, rates, taxes, and the subtotal.

Payment Terms: State the due date, payment methods, and any late payment policies clearly.

Total Amount Due: Calculate the final total (taxes included) with clarity.

Invoice Date: Add the issue date for accurate record keeping and deadline calculation.

Payment Instructions: Include account details or digital payment options for convenience.

Highlighting critical details like the due date ensures that your invoice demands attention and accelerates payment.

How to Make Sure Your Invoice Gets Paid Quickly

Getting paid swiftly boosts both cash flow and builds stronger buyer-seller relationships. Use these tried-and-tested strategies:

Issue Invoices Immediately: Don’t wait—send the invoice as soon as the product or service is delivered.

Leverage Automation Tools: Automate reminders using invoicing software like QuickBooks or Xero to keep clients on track.

Provide Multiple Payment Options: Offer choices like bank transfers, cards, or apps (e.g., PayPal, Stripe) to make payments convenient.

Set Clear Payment Expectations: Use concise terms like “Net 7” or “Net 30” to define deadlines.

Maintain Professionalism: Use well-formatted invoices that reflect credibility and encourage trust.

Tip

Use invoicing tools to schedule recurring invoices and send automatic reminders, saving time and avoiding missed payments.

Best Practices for Formatting an Invoice That Stands Out

Your invoice design might be the silent hero that unlocks faster payments for your business! Follow these design tips:

Keep It Clean and Simple: Structure your invoice logically with clear headings for sections like “Invoice Number” and “Payment Details.”

Use Professional Fonts and Sizes: Choose easy-to-read fonts and ensure critical details (e.g., totals and due dates) are bold or in a different color.

Avoid Clutter: Use tables for itemized details and leave white space for a clean look.

Highlight Key Information: Use bold text to emphasize the total amount due or due dates to draw attention.

Incorporate Branding: Adding your logo and using branded colors creates a professional, trustworthy impression.

A well-designed invoice not only impresses clients but also ensures easy payment processing.

The Best Ways to Follow Up on Overdue Invoices

Sometimes, a friendly reminder, perfectly timed, is all it takes to make sure your invoice gets paid! Here’s a simple process for following up on overdue invoices:

Set Automated Reminders: Before the due date, schedule courtesy reminders using invoicing software to warn clients in advance.

Follow Up Politely: If the due date has passed, send a polite email with the invoice attached, referencing the invoice number and due amount clearly.

Escalate Professionally: For payments significantly overdue, make a direct call or send a formal letter outlining late fees or penalties.

Keep Detailed Records: Maintain a record of all attempts to contact the client for your reference.

Define Next Steps: If payments remain unpaid, proceed with further actions like legal demands or enlisting a collection agency if necessary.

Avoid aggressive tones or threats during follow-ups—professionalism is key to preserving client relationships while resolving disputes.

By staying proactive and professional, you can keep overdue payments to a minimum and ensure smoother financial operations.