Creating an invoice with payment terms is essential for small business success, ensuring transactions are timely, accurate, and professional. A well-crafted invoice with designated payment terms sets up a smooth payment process. By clearly outlining essential details and payment guidelines, you avoid misunderstandings and enhance client trust.

To make your invoice effective:

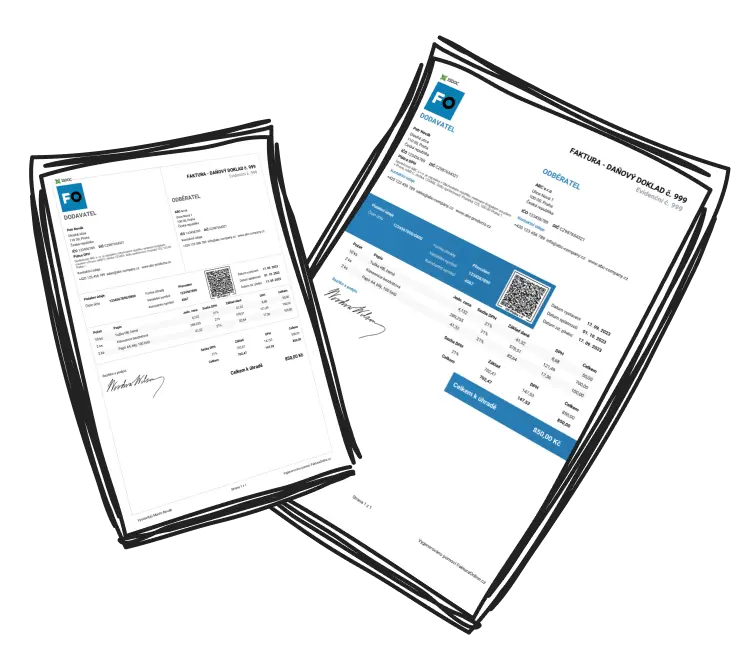

Start with the basic building blocks of a professional invoice:

Include your business name, logo, address, and contact information prominently. Add the client’s details, a unique invoice number, and the issue date for proper tracking.Itemize the charges clearly:

List the products or services rendered with descriptions, quantities, rates, and total amounts. Transparency is key so clients know exactly what they are being billed for.Clearly Define Your Invoice Payment Terms:

Make your invoice payment terms visible below the charge breakdown. Specify due dates (e.g., "Net 30" or "Due within 15 days"), and mention accepted payment methods like bank transfers or digital platforms. Make sure to include late payment penalties, such as a "2% late fee after 30 days overdue." You might also offer incentives like "2% off if paid within 10 days."Use professional language:

Replace vague terms like “ASAP” with specific phrases like “Payment due by [specific date].” Clarity prevents miscommunication and sets the tone for a professional relationship.

Tip

Here’s an example of a clear payment term you can copy:

“Net 30 – Payment due within 30 days of the invoice date. A 1.5% late fee will be charged monthly for overdue payments.”

Common Payment Terms Small Businesses Can Use:

Net 30: Payment due within 30 days.

Due upon receipt: Immediate payment required.

2/10 Net 30: 2% discount if paid within 10 days; full payment within 30 days.

Why Including Payment Terms is Non-Negotiable for Small Businesses

Payment terms are more than just a line item on your invoice—they are the backbone of your financial stability. By setting clear expectations on due dates and payment methods, you reduce the risk of late payments and misunderstandings.

Did you know?

Studies show that invoices with clear payment terms experience 20% fewer delays in payment compared to those without terms.

Payment terms also protect cash flow, allowing you to plan effectively for expenses like payroll and supplies. They establish mutual respect between you and your clients, signaling professionalism and efficiency in your business dealings.

Best Practices for Crafting the Perfect Invoice with Payment Terms

Following tried-and-tested strategies can make a big difference in how seamlessly your clients process payments. Here are some best practices to elevate your invoicing system:

Use logical, clear formatting:

Make your invoices easy to read by bolding due dates and amounts payable. Use consistent fonts and plenty of white space.Keep language polite yet firm:

Phrases like “We appreciate your prompt payment!” encourage cooperation without sounding harsh.Automate invoicing wherever possible:

Tools like QuickBooks or FreshBooks ensure your invoices are sent out on time, complete with reminders.List acceptable payment methods upfront:

Whether you accept credit cards, PayPal, or wire transfers, make paying as convenient as possible for your clients.Send invoices promptly:

Delayed billing often results in delayed payments, so issue invoices immediately after completing the work.

A Common Mistake to Avoid

“Payment is due soon.” This vague statement can lead to confusion. Instead, specify: “Payment due by November 15, 2023.”

Ensuring Customers Follow Your Payment Terms

One of the most challenging aspects of running a small business is making sure clients stick to the payment terms outlined in your invoice. However, proactive communication and small adjustments can work wonders.

Use automated reminders

Schedule a reminder email one week before the due date. Here's an example:

“Hello [Client Name], just a friendly reminder that invoice [#] is due on [date]. Please don’t hesitate to reach out if you need any assistance with processing the payment.”

The Risks of Letting Late Payments Slide

Allowing overdue payments without follow-up can quickly snowball into cash flow issues. Non-enforcement also sets a precedent that paying late is acceptable, undermining your professionalism.

To prevent this, follow a clear system:

Communicate payment terms during project discussions.

Send reminders before and after due dates.

Consistently apply late fees or interest penalties when terms are violated.

If dealing with consistent or high-ticket clients, consider options like upfront deposits or partial payments to reduce risk.

Why Invoices with Payment Terms are the Foundation of Small Business Success

Invoices with clear payment terms are a game-changer for small businesses. By improving cash flow predictability, they allow you to allocate resources efficiently and confidently pursue growth opportunities.

Beyond the financial benefits, using professional invoices fosters trust and credibility among your clients. Consistency in enforcing payment terms builds strong, respectful relationships, reducing disputes over finances.

In the long term, an effective invoicing system saves time, minimizes stress, and creates the financial discipline essential for growth. Small steps like automating reminders or incentivizing early payments can lead to sustained business resilience and better client retention.

By integrating payment terms into your invoicing process, you’re not just ensuring timely payments—you’re putting your business on the path to lasting success.