Filing order invoices is crucial for maintaining organized business operations and ensuring financial transparency. These documents capture transaction specifics like items sold, pricing, applicable taxes, and payment terms, serving as indispensable records. By establishing an efficient invoice filing system, companies not only streamline audits but also comply effectively with tax regulations.

Key Benefits of Filing Invoices

Filing order invoices accurately allows businesses to effectively track revenue and expenses, ensuring comprehensive financial management.

Ensures compliance with tax laws and local regulations.

Builds trust with suppliers and partners through accurate record-keeping.

Properly filed invoices not only enhance efficiency but also protect your business from financial errors and disputes, creating a solid foundation for operational success.

What Is the Essential Guide to Understanding Order Invoices?

To make the most of order invoices, it's crucial to understand and organize their components effectively.

Step-by-Step Guide to Understanding Invoices

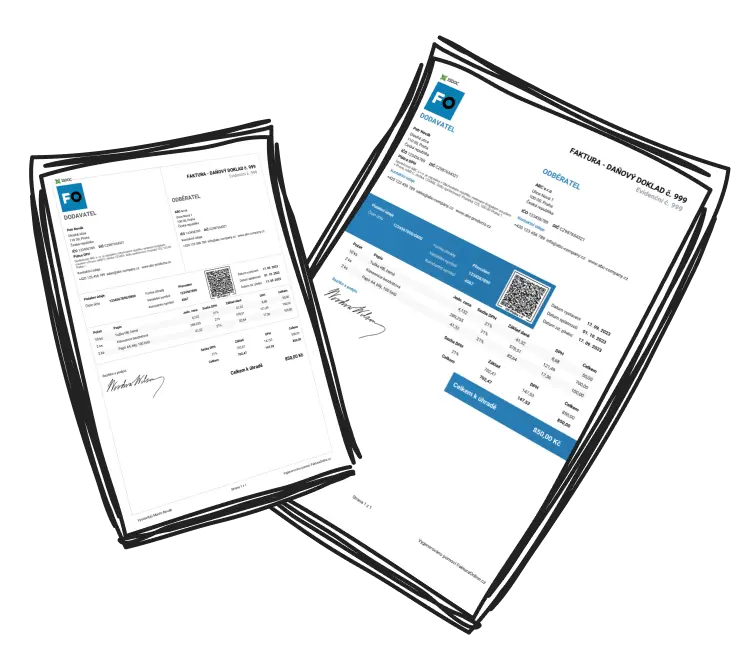

Identify Key Elements: Ensure every invoice includes essential details like seller and buyer information, invoice number, order specifics, taxes, and payment terms.

Cross-Check for Errors: Compare invoices with associated purchase orders to catch inconsistencies or mistakes early.

Leverage Digital Tools: Use invoicing software for accurate record creation, management, and storage.

Build Familiarity with Regulations: Understand tax codes and other compliance-related requirements to avoid penalties.

Tip

Automate your invoicing process with technology to save time and minimize errors.

How Can Filing Order Invoices Benefit Your Business?

Proper filing of order invoices offers businesses numerous advantages, transforming operational efficiency and success:

Streamlines Financial Management: Track accounts receivable and payable with ease to ensure smooth cash flow.

Simplifies Forecasting: Organized invoices make budgeting and financial planning more efficient.

Minimizes Errors: Proper documentation supports accurate inventory and supply chain management.

Reduces Audit Stress: Having clear, accessible records eases tax filing and audits.

Strengthens Relationships: Ensuring billing accuracy and timeliness enhances trust with suppliers and customers.

Example

A mid-sized company resolved supply chain issues and improved cash flow by implementing a robust invoicing system, demonstrating the tangible benefits of proper filing.

Why Does Understanding Order Invoices Matter for Your Business?

Order invoices play a pivotal role in driving business decisions and maintaining compliance. They provide insights into revenue trends, customer preferences, and supplier reliability, helping leaders make informed choices.

Attention to invoices helps avoid errors in pricing, tax deductions, and payment terms, safeguarding your company against fines or operational inefficiencies. Furthermore, it supports budgeting and forecasting, ensuring smooth day-to-day and strategic operations. Understanding order invoices is critical for long-term growth, professional reputation, and overall success.

What Happens If You Fail to File Order Invoices Correctly?

Neglecting to file order invoices accurately can lead to significant financial, legal, and operational setbacks, which could harm your business’s success. Mismanagement may result in cash flow disruptions, tax non-compliance penalties, and damaged supplier or customer relationships. Additionally, missing or incorrect invoices can create chaos during audits, wasting time and resources.

Poor management jeopardizes your profitability, tarnishes your reputation, and limits your ability to scale effectively.

Bringing It All Together: Master Order Invoices for Business Success

Order invoices are not just administrative documents—they’re vital tools for financial clarity, legal compliance, and business growth. By understanding their components and establishing efficient filing practices, businesses can avoid errors and penalties while improving operations.

Take Action Now:

Start leveraging digital tools and well-organized filing systems to master your invoicing process. A small shift can lead to remarkable growth and long-term success.